How to Break Into Leveraged Finance: A Wall Street Pro’s Step-by-Step Guide

Leveraged Finance operates in a high-stakes world where companies take on massive debt to fund their strategic corporate actions. The Internet buzzes with discussions about Leveraged Finance, and many people call it an excellent pathway to private equity careers.

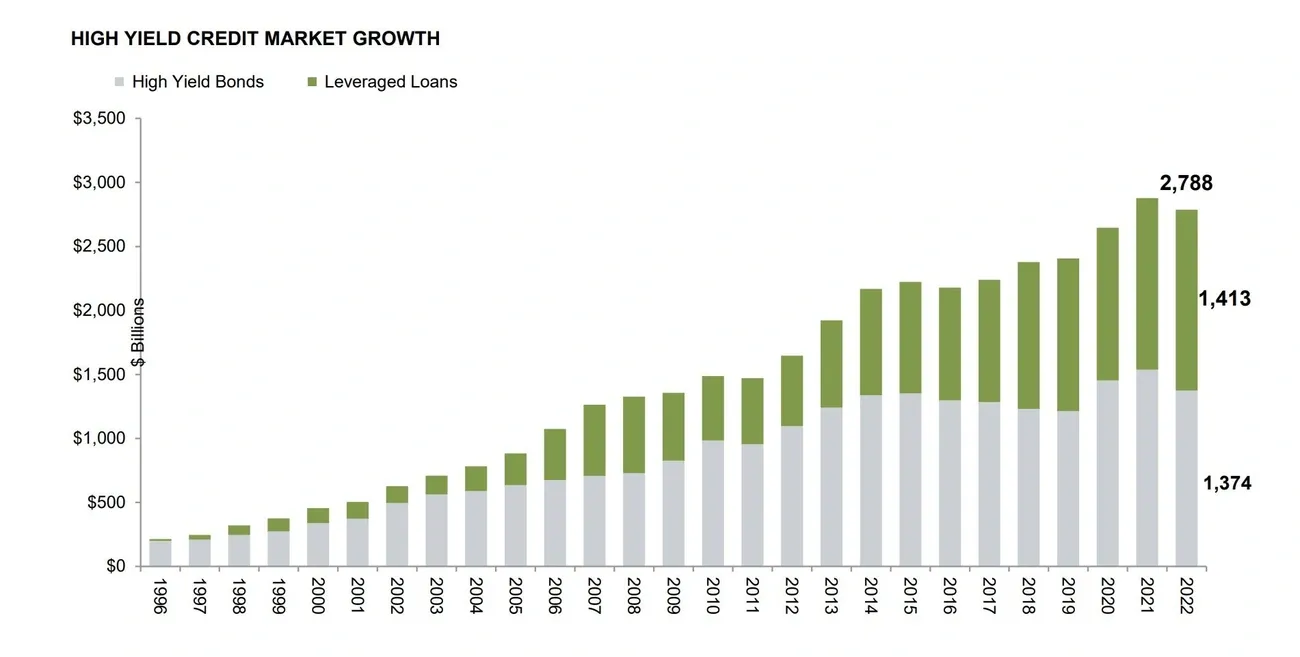

What makes leveraged finance unique? The term describes the financing of highly levered, speculative-grade companies. The amount of debt soars nowhere near normal industry standards. Creditors set strict limits on risk acceptance and leverage allowance. These speculative-grade debt instruments make up a smaller percentage of total corporate debt issuances in the US because of their risky nature.

Breaking into this exciting yet challenging field needs a well-planned approach. This detailed guide shows you five significant steps to start your Leveraged Finance career. You’ll learn everything from basic fundamentals to technical skills that position you perfectly during recruitment. Ready to take a closer look at the world of high-yield debt and complex capital structures? Let’s begin!

Step 1: Understand What Leveraged Finance Is

Image Source: Wall Street Prep

Success in leveraged finance starts with learning its core fundamentals. The world of leveraged finance stands apart from traditional corporate finance because debt takes center stage.

What is leveraged finance and how it works

Leveraged finance deals with financing highly levered, speculative-grade companies, those with credit ratings below investment grade (typically Ba1/BB+ or lower). These companies take on much more debt than what their industry considers standard. The average debt/EBITDA ratio for non-financial companies in the FTSE100 sits at 1.5X, while leveraged transactions can reach total Debt/EBITDA ratios up to 6.5X.

Investment banks’ Leveraged Finance group (known as “LevFin”) partners with corporations and private equity firms to raise debt capital through various channels. They help clients direct complex financial structures by syndicating loans and underwriting bond offerings.

The biggest difference shows up in its purpose, this isn’t debt for everyday operations. LevFin specializes in debt used for specific strategic transactions. The financing structure combines senior bank debt and subordinated debt securities that reshape a company’s capital structure.

How it is different from DCM and corporate banking

While leveraged finance technically belongs to Debt Capital Markets (DCM), each serves its own distinct purpose:

- Focus: DCM handles investment-grade debt issuances for everyday business purposes, while LevFin tackles below-investment-grade issuances for more complex transactions.

- Risk profile: LevFin works with higher-risk, higher-yielding instruments (“high-yield bonds” or “leveraged loans”), as DCM manages lower-risk, investment-grade issuances.

- Analysis requirements: DCM runs largely as a flow business with minimal credit work and focuses on rates. LevFin demands extensive financial modeling and firm-specific credit analysis.

- Client base: DCM investors are usually large asset management firms looking for stability. LevFin investors include hedge funds and other institutions ready to take higher risks for better returns.

Corporate Banking sets itself apart by focusing on ‘bank debt’ (Revolvers and Term Loans) that stays on the bank’s balance sheet instead of being syndicated to outside investors. Corporate banking also provides additional services beyond debt issuance.

Common use cases: LBOs, M&A, recapitalizations

Leveraged finance supports several strategic corporate actions:

Leveraged Buyouts (LBOs): Private equity firms combine cash and debt to acquire companies. These deals typically see 50-60% of the purchase price funded through borrowed money. The acquired company’s assets become collateral, and its future cash flows go toward debt repayment.

Mergers & Acquisitions: Companies often turn to leveraged finance when buying other businesses. This approach propels growth without needing significant upfront capital.

Leveraged Recapitalizations: Companies reshape their capitalization structure by swapping equity with debt securities. Like LBOs, this increases financial leverage, though companies might stay publicly traded. These recaps can create tax benefits through debt’s tax shield and boost metrics like earnings per share.

Refinancings: Companies raise new debt as their existing debt nears maturity to pay off and replace the old balance. This strategy helps manage debt levels and might secure better terms.

Dividend Recapitalizations: New debt gets issued specifically to pay dividends to investors, a strategy private equity firms use to boost returns while keeping their ownership stake.

Step 2: Learn the Key Debt Instruments

Becoming skilled at understanding different debt instruments is vital to break into leveraged finance. These financial tools are the foundations of every deal. Each has unique characteristics that define how they work in complex capital structures.

Leveraged loans vs. high-yield bonds

Leveraged loans are at the heart of most leveraged transactions. These senior secured loans usually have floating interest rates based on LIBOR or SOFR plus a spread. They need regular principal amortization. They get first priority claims on a company’s assets, which makes them safer options for lenders.

Key characteristics of leveraged loans include:

- Secured status: Company assets back them as collateral

- Floating rates: Prices move up or down with market interest rates

- Shorter maturities: Usually 5-8 years

- Stricter covenants: Borrowers face more restrictive conditions

- Principal amortization: You need to pay down regularly

High-yield bonds (also called “junk bonds”) sit lower in the capital structure. These fixed-rate instruments usually offer higher interest rates because investors take on more risk. High-yield bonds come with less restrictive covenants than leveraged loans, which gives issuers room to operate freely.

Leveraged loans perform better than high-yield bonds at the time interest rates rise because of their floating-rate structure and lower duration. High-yield bonds deliver better returns when rates drop, thanks to their fixed coupons and higher interest rate sensitivity.

Understanding mezzanine debt and equity kickers

Mezzanine debt bridges the gap between traditional debt and equity – that’s why it’s called “mezzanine” (like a middle floor in a theater). This hybrid financing takes features from both worlds. It ranks below senior debt but above common equity in repayment priority.

Mezzanine financing stands out for its higher return potential, usually aiming for 12-20% returns through:

- Cash interest payments

- Payment-in-kind (PIK) interest that adds to the principal

- “Equity kickers” that offer upside potential

Equity kickers let mezzanine investors share in a company’s equity upside. They often come as warrants (options to buy stock at set prices), convertibility features, or direct co-investment rights. These kickers help reach the higher returns investors expect (18-25%) for taking subordinated positions, beyond the standard interest rate of about 10%.

Where these instruments sit in the capital structure

The capital structure creates a clear order of who gets paid first, especially in tough times. Senior secured loans take the top spot. Second-lien debt, high-yield bonds, mezzanine financing, preferred equity, and common equity follow in that order.

This order affects both risk and potential returns. Senior instruments give lower yields but better security. Subordinated instruments pay more to make up for higher risk. To name just one example, leveraged loans might yield LIBOR plus 3-4%, while mezzanine debt aims for returns of 15% or higher.

Recovery rates show this ranking clearly. Senior secured loans get back around USD 63.40 per USD 100 in defaults, while subordinated bonds recover only USD 41.60. These numbers show why building a well-laid-out capital stack matters so much to both issuers and investors in leveraged transactions.

Step 3: Build the Right Skill Set

You need a unique set of technical skills to succeed in leveraged finance. These skills go beyond standard financial knowledge. The path ahead involves analyzing risky debt and explaining complex structures to clients.

Financial modeling and credit analysis

Leveraged finance needs more sophisticated financial modeling than traditional corporate banking. Working with less creditworthy companies means you’ll spend a lot of time stress-testing businesses under various scenarios. You’ll assess how credit metrics and liquidity perform under pressure. Your work involves building different financing structures. You’ll compare subordinated notes against mezzanine financing or preferred stock and analyze their effects on returns.

Your models should show:

- How debt affects financial statements

- Deal viability through different scenarios

- Source and uses schedules with detailed capitalization tables

- Post-deal credit statistics and comparable company metrics

Ready to add “Leveraged Finance” to your resume? Grab our guide specifically for finance students.

Without doubt, excellent credit skills are vital since these loans carry higher risk than DCM or corporate banking. The work needs more detailed parameter analysis and scenario testing than investment-grade debt.

Understanding legal documents and covenants

Legal knowledge is vital in leveraged finance. You’ll review many credit documents, amendments, and other agreements. These skills come only from studying dozens of examples.

Credit covenants protect loans by setting limits on what borrowers can do without lender approval. These provisions stop borrowers from taking actions that might hurt their ability to pay back loans.

A full picture of covenant packages gives you insight into balancing investor protection with operational flexibility. Financial covenants usually include leverage ratios, interest coverage ratios, and fixed charge coverage ratios. These measure a company’s ability to handle debt.

Presentation and communication skills

Top performers in leveraged finance stand out through excellent communication. Clear and confident explanations of complex analyzes matter to colleagues and clients alike. Market presentations show recent issuances, mutual fund flows, current interest rates, and other stats to prove favorable market conditions.

Strong presentation skills help you share financial insights clearly and build better relationships throughout your career. Having both short and detailed versions of your analyzes lets you adapt to different audiences. You can give high-level summaries to senior bankers while keeping detailed explanations ready.

Knowing how to simplify technical content and connect with audiences through clear, focused communication will boost your professional growth by a lot.

Step 4: Prepare for Recruiting and Interviews

Getting into leveraged finance takes more than technical knowledge. You need a smart approach to recruiting and interviewing. A coveted position requires careful preparation to stand out from other candidates.

How to tailor your resume for LevFin

Your resume should highlight specific expertise that LevFin groups value. Show your analytical capabilities through measurable achievements that prove your credit analysis skills. Add your experience with financial modeling, transaction execution, and industry knowledge.

Key elements to include:

- Experience coordinating marketing presentations and offering documents

- Skills in building financial models for credit committee reviews

- Background in transaction execution and documentation processes

- Industry knowledge of sectors like TMT, energy, or healthcare

Note that numbers matter a lot in finance recruiting, so keep your GPA high (shoot for 3.8+). Pick a major in accounting/finance or a closely related field to stay in the running with recruiters.

Common technical and behavioral questions

Technical questions test your knowledge of debt structures, valuation methods, and markets. You’ll likely face questions about LBO debt facilities, optimal leverage levels across industries, and ways to review companies.

For behavioral questions, have stories ready that show your:

- Teamwork capabilities

- Leadership experience

- Conflict resolution skills

- Knowing how to learn from failure

- Creative problem-solving

The assessment is mostly subjective. Interviewers look at your maturity, comfort with ambiguity, emotional intelligence, and cultural fit rather than seeking “right” answers.

Networking tips and target schools

Top target schools include University of Pennsylvania (Wharton), New York University, University of Michigan, and Ivy League institutions. Notwithstanding that, coming from a non-target school doesn’t rule you out—but you’ll need to work harder to get interviews.

Smart networking moves include:

- Attending graduate school events and industry conferences

- Joining professional organizations in finance

- Making your LinkedIn profile stand out and staying active online

- Setting aside weekly time for networking

Building genuine relationships matters more than transactional networking. Show real interest in others and ask thoughtful questions. In fact, LinkedIn data shows 85% of jobs are filled through networking. Your relationships could be your most valuable career asset.

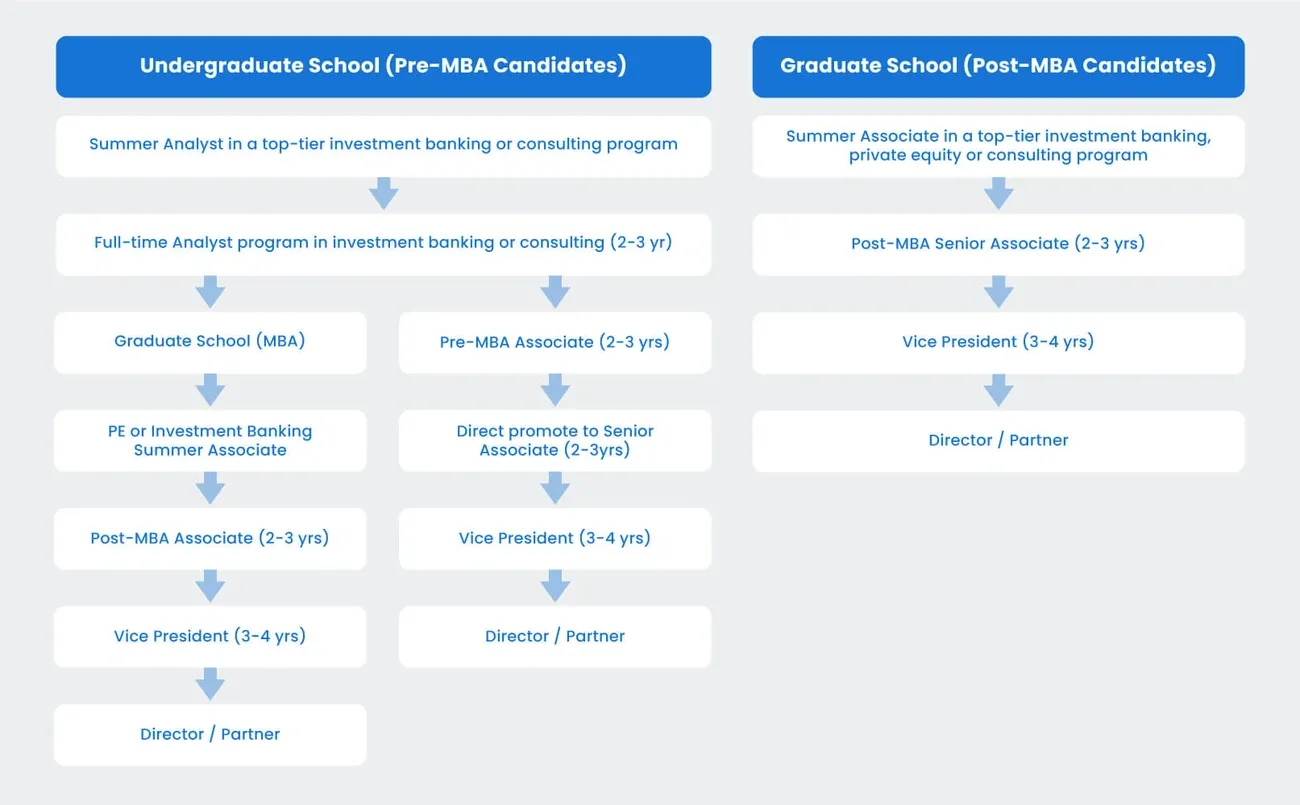

Step 5: Know the Career Path and Exit Options

Image Source: DealRoom.net

Your career path in leveraged finance becomes clearer when you understand where it might lead. A good grasp of internal growth opportunities and career options helps you plan your professional future better.

Analyst to associate progression

Most professionals start as analysts for 2-3 years before becoming associates. Banks now want their analysts to stay longer by offering faster promotions, protected weekends, and additional time off. You need to show leadership skills by helping junior analysts, prove your worth beyond your pay, and build strong relationships with senior bankers to earn that promotion.

Exit opportunities: PE, credit funds, direct lending

Leveraged finance opens several career paths:

- Direct Lending Funds – These funds grow faster as traditional banks step back

- Credit Hedge Funds – Your credit analysis expertise makes you valuable

- Private Equity – Buyout and distressed PE funds value your skills highly

- Mezzanine Funds – This path works well if you come from modeling-focused teams

Many leveraged finance bankers move to private equity, contrary to popular belief. Distressed debt hedge funds are another good option, though you might need extra bankruptcy knowledge that LevFin doesn’t typically provide.

LevFin vs. M&A for private equity exits

M&A offers more direct paths to PE than LevFin. Your deep understanding of balance sheets from LevFin work prepares you well for private equity’s long-term investment approach. LevFin professionals also gain an edge over M&A teams through their extensive experience with covenants and credit agreements.

Conclusion

A career in leveraged finance needs careful planning, deep knowledge, and constant skill building. This piece has shown you what makes leveraged finance different from corporate finance and DCM. The high-stakes world of finance, with debt-to-EBITDA ratios up to 6.5X, needs professionals who can handle complex capital structures and work with different debt instruments.

Your path to success depends on becoming skilled at financial modeling and credit analysis. Evaluating companies under stress scenarios is a vital part of the job. On top of that, a solid grasp of legal documents and covenants will help you stand out when applying for roles.

Getting ready for interviews means focusing on both technical knowledge and behavioral questions. Practice how you’d explain LBO debt facilities, optimal leverage levels, and company evaluation methods. Keep building your network too – today’s connections could become tomorrow’s job leads.

The path from analyst to associate is well-laid-out. Exit options give you room to shape your career goals. Private equity, credit funds, and direct lending are all solid career choices. In stark comparison to what many believe, leveraged finance gives you excellent preparation for private equity roles because you focus deeply on balance sheets and work extensively with credit agreements.

This complete guide gives you the tools to start your leveraged finance career. The journey has its challenges, but mixing technical skills, clear communication, and smart networking will help you succeed in this ever-changing field.