How to Solve Any Accounting Equation: Simple Steps for Better Grades

The accounting equation stands as the fundamental formula that shapes all accounting principles. Your academic success depends on becoming skilled at this simple yet powerful equation, whether you face homework challenges or prepare for exams.

Assets = Liabilities + Equity represents the simple accounting equation. This formula makes accounting work and keeps the balance sheet aligned through matching entries on debit and credit sides. Each financial transaction impacts the accounting equation while maintaining perfect balance.

Accounting calculations and expanded equations might seem daunting now. This piece will walk you through clear steps that solve any accounting equation. You’ll learn to sidestep common mistakes and elevate your grades with real-world examples. Those challenging homework problems will feel much more manageable after reading this guide.

What Is the Accounting Equation and Why It Matters

The accounting equation is the life-blood that powers the entire field of accounting. This fundamental principle shapes every financial transaction recorded in business and creates the foundations for understanding a company’s financial position.

Definition of the basic accounting equation

The accounting equation states that Assets = Liabilities + Equity. This elegant formula shows the relationship between a company’s assets (what it owns), liabilities (what it owes), and the owner’s equity (their residual interest).

You can rearrange the equation in several ways to highlight different aspects:

- Assets = Liabilities + Equity

- Equity = Assets – Liabilities

- Liabilities = Assets – Equity

Each element has a specific role:

Assets are valuable resources a company controls with positive economic value. These can be tangible (equipment, machinery) or intangible (patents, trademarks).

Liabilities represent a company’s obligations that will need future cash outflows, including loans, accounts payable, and accrued expenses.

Equity (or Shareholders’ Equity) represents the company’s net assets—what would remain after liquidating all assets and paying all liabilities.

Why it’s the foundation of all accounting

People often call the accounting equation the “balance sheet equation” because it keeps the balance sheet balanced. This principle establishes that company resources must match their funding sources.

The equation also works as an error detection tool. Any mismatch between the sum of debits and credits for all accounts signals an error in the recording process.

The accounting equation helps you:

- Check your bookkeeping accuracy

- Understand financial statements correctly

- Make better financial decisions

- Catch accounting errors early

The equation guides accountants to record transactions and report their summaries in financial statements. It reveals what an organization owns and who has claims against those resources.

How it supports double-entry bookkeeping

Double-entry bookkeeping builds on the accounting equation and requires each transaction to affect at least two accounts. This system makes sure:

- Each transaction has equal and opposite entries in at least two accounts

- Total debits equal total credits

- The accounting equation stays balanced

Double-entry bookkeeping requires recording changes in at least two different accounts for every transaction. To name just one example, a $15,000 bank loan would increase both assets and liabilities by $15,000.

A $5,000 cash equipment purchase would decrease cash assets by $5,000 but increase equipment assets by the same amount, keeping everything balanced.

This dual recording approach ensures accurate financial statements. On top of that, it makes accounting more standardized and reduces errors since every transaction must balance the accounting equation.

Learning this equation and its role in double-entry bookkeeping will help you solve accounting problems better and improve your accounting course grades by a lot.

Breaking Down the Equation: Assets, Liabilities, and Equity

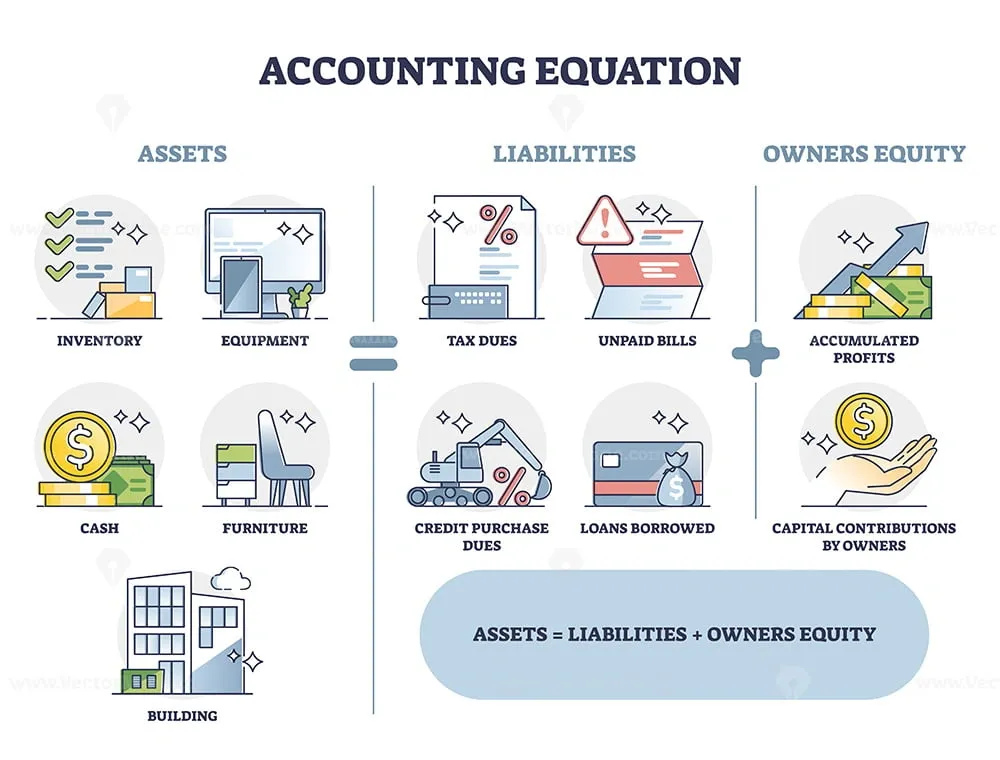

Image Source: VectorMine

You need to understand three core components to learn the accounting equation. Each element plays a significant role to balance your financial records and solve accounting problems correctly.

What are assets?

A company’s assets include anything valuable it owns or controls that can provide current or future economic benefits. These resources help operate your business and generate value.

Assets appear on the left side of the accounting equation and can be categorized in several ways:

- By convertibility: Current assets (convertible to cash within a year) such as cash, accounts receivable, and inventory; and Fixed assets (long-term) like land, buildings, and equipment

- By physical existence: Tangible assets (physical) like machinery and furniture; and Intangible assets (non-physical) such as patents, trademarks, and intellectual property

- By usage: Operating assets (required for daily operations) and Non-operating assets (not required for daily operations but can still generate revenue)

Your first step in solving the accounting equation is identifying assets correctly. Note that assets must always equal the sum of liabilities and equity. Any miscategorization can throw off your entire calculation.

Understanding liabilities

Liabilities are financial obligations your company owes to other entities. These represent what you owe rather than what you own.

Liabilities appear on the right side of the balance sheet among equity and fall into two main categories:

- Current liabilities: Debts due within 12 months, such as accounts payable, wages payable, and short-term loans

- Long-term liabilities: Obligations due more than a year from now, including long-term loans, bonds, and mortgage payments

Some companies also track contingent liabilities, potential obligations that depend on future events, such as lawsuit outcomes or warranty claims.

Your general ledger makes calculating total liabilities straightforward: just add up all the liabilities. The formula derived from the accounting equation is: Liabilities = Assets – Equity.

The role of equity in the equation

Equity represents the owner’s or shareholders’ claim on the business’s assets after all liabilities are paid. This residual interest shows what remains in the company’s assets once debts are settled.

Sole proprietorships call it “owner’s equity,” while corporations use “shareholders’ equity”. The term may differ, but equity remains the third pillar of the accounting equation.

The formula for calculating equity is: Equity = Assets – Liabilities

This formula works for all business types, though equity presentation varies by business structure. Corporations’ shareholders’ equity typically has contributed capital (shareholder investments) and retained earnings (profits kept in the business).

The connection between equity, assets, and liabilities is vital to solve expanded accounting equation problems. Changes in one component affect the others, which maintains the balance needed for accounting calculations.

These three components will help you solve any accounting equation problem. You can identify errors in calculations and get better grades in your accounting courses.

How to Solve the Accounting Equation Step-by-Step

Becoming skilled at the accounting equation needs a step-by-step approach to problem-solving. The equation works in its simple form (Assets = Liabilities + Equity) or expanded version. A systematic process helps you solve any accounting equation with confidence.

Identify known values

The first step to solve accounting equations starts with what you already know. Look for specific figures in each component:

- Find the total assets – Check the balance sheet of your accounting period and find the organization’s total assets.

- Determine all liabilities – Calculate the sum of all liabilities from the same period. These should include accounts payable, loans, and other company obligations.

- Locate equity figures – Calculate the shareholder’s equity or owner’s equity value. Most organizations receive contributions from shareholders who fund projects.

Your sources need verification. Balance sheets, income statements, and detailed financial records ensure accuracy. These original steps build the foundation to apply the accounting equation correctly.

Rearrange the formula if needed

After gathering your values, the accounting equation might need rearrangement to find a missing variable. The equation’s flexibility helps you find any unknown term with the other two:

- To find assets: Assets = Liabilities + Equity

- To find liabilities: Liabilities = Assets – Equity

- To find equity: Equity = Assets – Liabilities

To name just one example, see a company with $400,000 in assets and $100,000 in liabilities. The equation rearranges to find equity: $400,000 – $100,000 = $300,000.

This method helps you find any unknown value with the other two components.

Plug in the numbers and solve

The solution becomes clear once you have the right formula and known values:

- Substitute the known values into your rearranged equation.

- Perform the calculation to find the unknown value.

- Verify your answer with the original equation to ensure balance.

Let’s look at a real-life example: A company shows total assets of $170 billion and total liabilities of $120 billion. The shareholders’ equity calculation shows $170 billion – $120 billion = $50 billion.

The verification needs Assets = Liabilities + Equity: $170 billion = $120 billion + $50 billion. Your calculation proves correct when both sides match.

Expanded accounting equations use the same process but add more equity components like contributed capital, retained earnings, revenue, expenses, and dividends. Complex problems work the same way if you keep the fundamental balance principle.

This systematic approach helps you tackle any accounting equation problem on homework or exams accurately and confidently.

Common Mistakes Students Make (and How to Avoid Them)

Smart students sometimes struggle with the accounting equation. You can avoid errors and boost your accuracy in accounting calculations by knowing the most common mistakes.

Misclassifying accounts

Transactions often end up in wrong categories when people mix up accounts, like treating an asset as an expense or recording revenue as a liability. These small mistakes create incorrect entries that distort your financial position by a lot. Here’s what usually goes wrong:

- Capital assets get logged as expenses instead of depreciable assets

- Expenses end up assigned to incorrect business entities

- Liabilities appear in the balance sheet’s equity section

Your accounting system’s data quality depends on what you input. Wrong account classifications throw off the accounting equation’s balance and show incorrect values for assets, liabilities, or equity. Clear coding guidelines and proper transaction verification before recording can prevent these errors.

Forgetting to record transactions

Missing transactions happen when accountants overlook entries completely. These oversights mess up your accounting equation and paint the wrong financial picture. People often forget to record:

- Petty cash transactions

- Minor expenses

- Inventory adjustments

- Supply purchases

These gaps affect how well you can solve the simple accounting equation. A systematic approach helps, set up daily entry routines, organize receipt collection, and review accounts regularly.

Data entry errors in accounting calculations

Data entry mistakes top the list of preventable accounting errors. Watch out for:

- Transposition errors: Numbers that flip around (writing 52 instead of 25)

- Duplication errors: Same transaction shows up twice

- Decimal place errors: $100.00 becomes $10.00

These mistakes throw off your accounting equation balance. Manual data entry achieves 96-99% accuracy, while automated systems hit 99.99%. Double-entry accounting helps catch these errors by requiring matching debits and credits. Regular account reconciliation and good accounting software can automate data entry and reduce mistakes.

Practice Examples to Boost Your Grades

Working through actual examples will sharpen your accounting skills. You’ll get into practical applications that will help you become skilled at the accounting equation and boost your test scores.

Simple example with owner investment

A business owner invests $10,000 to start a company. This transaction increases both assets (cash) and owner’s equity by $10,000. The accounting equation stays balanced:

- Assets: $10,000 (Cash)

- Liabilities: $0

- Equity: $10,000 (Owner’s Capital)

Example with loan and asset purchase

A business takes out a $10,000 loan from a bank. The assets (cash) increase by $10,000 and liabilities increase by $10,000. The company then purchases equipment for $5,000 cash. This changes assets from cash to equipment without affecting the equation’s total.

The business later pays $2,000 toward the loan:

- Assets decrease: $58,000 (down from $60,000)

- Liabilities decrease: $28,000 (down from $30,000)

- Equity remains: $30,000

Expanded accounting equation in action

The expanded equation breaks down equity components in detail: Assets = Liabilities + (Contributed Capital + Beginning Retained Earnings + Revenue – Expenses – Dividends)

A sole proprietorship has $150,000 in assets, $50,000 in liabilities, $80,000 in owner’s capital, $60,000 in revenues, $30,000 in expenses, and $10,000 in withdrawals: $150,000 = $50,000 + [$80,000 + ($60,000 – $30,000 – $10,000)]

Conclusion

Students who want to excel in accounting must become skilled at using the accounting equation. This piece has taught you the core formula, Assets = Liabilities + Equity. This fundamental equation forms the foundations of accounting practices and financial record-keeping. Each component plays a crucial role to maintain balanced financial statements and support the double-entry bookkeeping system.

You now have a reliable framework to solve any accounting equation, from simple to expanded versions. Your accuracy will improve substantially if you avoid common mistakes like misclassifying accounts or making data entry errors. The examples show how different transactions affect the accounting equation while keeping it balanced.

Practice with ground examples is the best way to strengthen these concepts. Regular application of these principles will build your understanding and make you more confident in solving accounting problems. Want to explore more about accounting? Our expert guides on accounting and finance are here to help.

The accounting equation should be central to your problem-solving approach as you progress in your accounting experience. This core principle helps you earn better grades and creates a strong foundation for the advanced concepts you’ll study in your academic and professional career.